contra costa county sales tax increase 2020

California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated. A yes vote supported authorizing an additional sales tax of 05 for 20 years generating an estimated 81 million per year for essential services including the regional hospital community health centers emergency response safety.

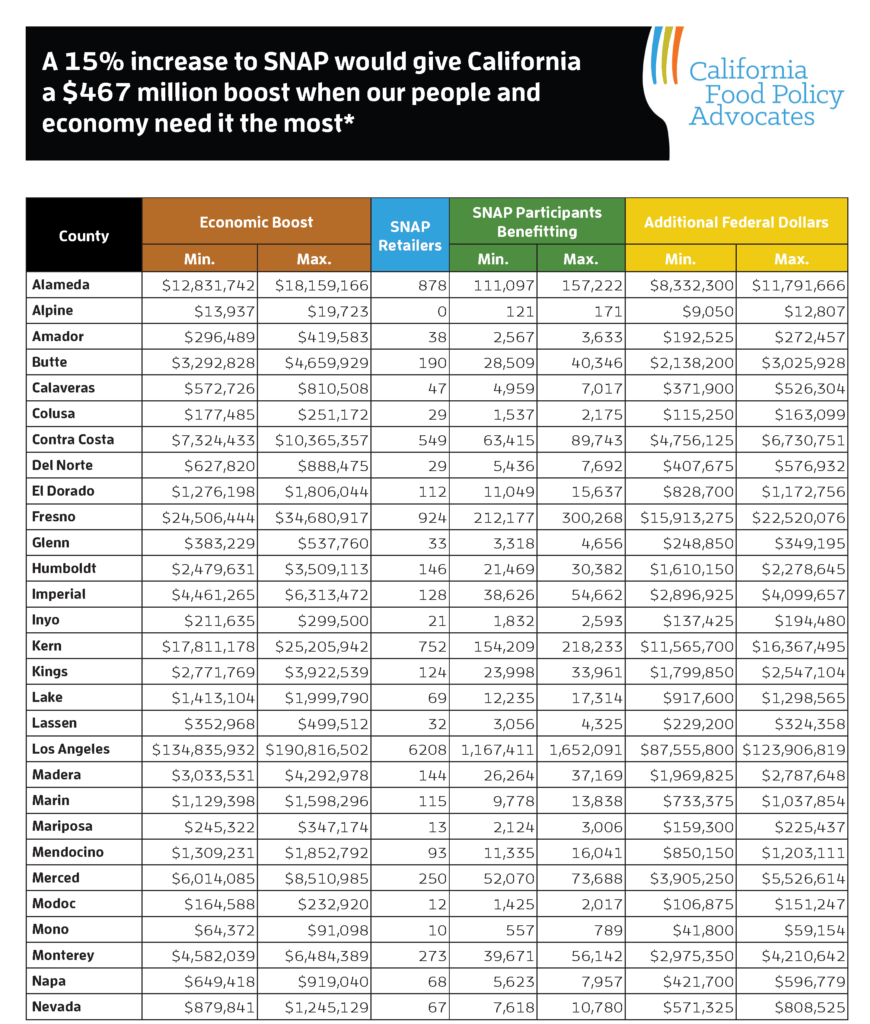

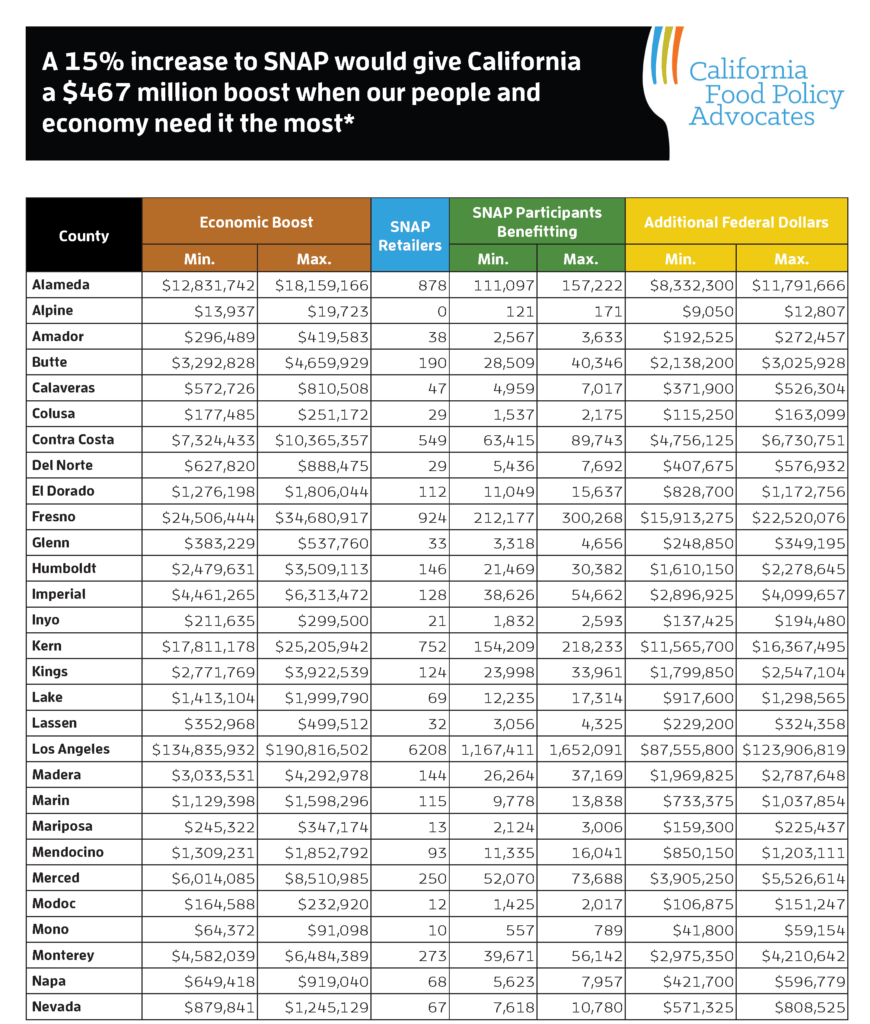

What If Snap Benefits Increased By 15 Nourish California

2021 - Quarter 4 Not yet released 2021 - Quarter 3 Not yet released 2021 - Quarter 2 PDF 2021 -.

. The December 2020 total local sales tax rate was 8250. Contra Costa County voters passed the Measure X countywide half-cent sales tax increase on the November 2020 ballot. This is the total of state and county sales tax rates.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. A no vote was a vote against increasing the service area parcel tax by 140 per parcel to fund police. Food sales are exempt and the county estimates the tax would raise.

In 2020 Contra Costa County voters approved Measure X a half-cent sales tax that ended up paying for an array of service enhancements by a large margin. He changed it to Transactions and use taxes. The California state sales tax rate is currently.

The current total local sales tax rate in Contra Costa County CA is 8750. Posted by angela angie a resident of San Ramon on Oct 30 2020 at 255 am angela angie is a registered user. Contra Costa County California Sales Tax Rate 2022 Up to 1075.

Triple Flip Unwind PDF Sales Tax Primer PDF 2021. Contra Costa County Raised from 825 to 875 El Sobrante Discovery Bay Rodeo Crockett Byron Bethel Island Diablo Knightsen Port Costa and Canyon. Contra costa county sales tax measure 2020.

The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc. The Contra Costa County Sales Tax is collected by the merchant on all. The supervisors will also receive a report on Capital Projects the Facilities Condition Assessment and the Facilities Master Plan.

The city estimates the tax raises 145 million a year at the 05 rate and would raise 725000 a year at the 025 rate for the general fund. A county-wide sales tax rate of 025 is applicable to localities in Contra Costa County in addition to the 6 California sales tax. 41 rows Contra Costa County Measure X was on the ballot as a referral in Contra Costa County on November 3 2020.

1 The city increased its existing tax of 050 percent CNCD to 100 percent CNTU in addition to the Contra Costa countywide increase of 050 percent listed in the countywide table. Look up the current sales and use tax rate by address. Concord voters will consider Measure V which also would continue and increase an existing sales tax from 05 to 1.

That would bring Contra Costas sales-tax rate up to. Contra Costa County. Contra Costa County was not alone tax proposals in Alameda Santa Clara San Mateo Marin and Solano counties also approved various tax hikes.

Wed Jul 29 2020 1033 am. It took some maneuvering in the State Senate Governance Finance Committee to get the bill to the floor for a full vote. Background full text and financial analysis contra costa county measure t.

Wed Jul 15 2020 1239 pm 13. Some cities and local governments in Contra Costa County collect additional local sales taxes which can be as high as 45. Measure X is a sales tax measure thats expected to generate 81 million dollars a year for the next 20 years.

On November 3 2020 Contra Costa County voters approved a half cent retail sales tax increase that will take effect on April 1 2021. The tax would raise an estimated. 31 the last day of the legislative session the California State Senate passed SB1349 authored by Senator Steve Glazer D-7 Orinda to allow Contra Costa County Supervisors to place a half-cent sales tax.

One measure Regional Measure 3 was voted on throughout the entire county as. Would raise an estimated 81 million per year. If it passes sales tax would increase by half a percent on most goods but not on necessities like food and medicine.

Will cost county 547700 even if he vetoes bill. The Contra Costa County sales tax rate is. The Contra Costa County Board of Supervisors will proceed with pursuing a half-cent 20-year sales tax measure for Novembers general election ballot though it could be derailed if a bill now languishing in Sacramento isnt passed by the end of July.

A new half-cent sales tax to raise an estimated 81 million a year mostly for social services moved closer to the November election ballot Tuesday but delays in passing a certain state Senate bill could still derail it. Contra costa measure x 100. Measure X - Contra Costa County Sales Tax.

County of Contra Costa on April 8 2020 after the March Primary election was decided and the countywide additional half-cent sales tax increase for transportation failed. Election results Nov 4 2020 November 2020 Election. Glazers bill would allow Contra Costa County to put forward the tax measure with revenues going to its general fund and do so by only a simple majority vote.

The minimum combined 2022 sales tax rate for Contra Costa County California is. This applies to taxable sales in El Cerrito and the tax rate will be 1025. It was approved.

Adjusted for aberrations sales and use tax revenues for all of Contra Costa County including its cities rose 14 over the comparable time period while the nine county bay area as a whole was down 05. Eight measures were on the ballot in Contra Costa County on June 5 2018. CA Sales Tax Rate.

Contra Costa County Fourth Quarter Receipts for Third Quarter Sales July - September 2019 Published by HdL Companies in Winter 2020 Alamo. 2 The city increased its existing tax of 050 percent GZGT to 100 percent GZTU and extended the expiration date to March 31 2044. The Contra Costa County Sales Tax is 025.

Insights Digital Frontiers Institute

2010 2020 Retrospective Of Courthouse Design By Ncsc Courthouse Planning Issuu

Insights Digital Frontiers Institute

Pandemic 2020 Bisbee Az Official Website

Insights Digital Frontiers Institute

Coronavirus Updates The Business Assistance Program Lafayette Chamber Of Commerce